In today’s complex regulatory atmosphere, conformity is greater than a plain need; it’s a basic component of sustaining a business. Recognizing the compliance landscape and integrating best techniques can cause success and minimize lawful risks.

Understanding Conformity Fundamentals

Compliance describes sticking to laws, guidelines, requirements, and ethical techniques appropriate to your industry. Effective compliance aids firms stay clear of charges and improve credibility.

The Value of Conformity

- Preventing Lawful Penalties : Non-compliance can lead to substantial fines and lawful ramifications.

- Reputation Administration : Companies known for conformity are usually relied on more by clients and stakeholders.

- Operational Performance : A clear understanding of conformity can enhance operations and improve operations.

Key Conformity Methods

Develop a Conformity Society

Cultivating a culture of compliance within your organization is important. This starts on top, where leadership should prioritize moral actions and compliance methods.

Conduct Routine Training

Educating workers on conformity problems makes certain every person understands their responsibilities. Routine training sessions ought to be a staple in your conformity program.

Execute Robust Plans

Establish clear, comprehensive compliance plans tailored to your sector. These ought to deal with particular regulations, procedures, and standards.

Screen Conformity Continually

Regular audits can assist discover compliance voids and locations for renovation. Monitoring systems guarantee adherence and advertise liability.

Associated Searches

- Compliance training best techniques

- Regulative conformity checklist

- Significance of conformity in organization

- How to perform a compliance audit

- Role of a compliance policeman

Regularly Asked Concerns

What are the key goals of compliance programs?

The primary goals are to guarantee adherence to legal requirements, recognize dangers, and preserve honest techniques within the company.

Just how can small companies implement efficient conformity techniques?

Local business can begin by developing tailored policies, engaging workers via training, and utilizing offered sources to stay educated about market guidelines.

Expert Insights: Interview with a Conformity Professional

Q: What are the most significant challenges in the present conformity landscape?

A: Among the greatest obstacles is staying on top of ever-changing guidelines. Companies need to be positive in monitoring adjustments and adjusting their plans appropriately.

Q: What suggestions would you offer to organizations having problem with compliance?

A: My key recommendations is to purchase training and sources. Involving with compliance specialists can provide useful insights and boost your program’s performance.

Verdict

Browsing the conformity landscape can be complicated, yet with a concentrated method, companies can attain success. By cultivating a conformity culture, conducting normal training, applying robust policies, and constantly checking infractions, businesses can reduce dangers and boost their standing in the market. Remember that conformity is not practically meeting governing demands however creating a foundation for ethical organization methods. For even more specialist insights, maintain involving with experienced compliance specialists in your area.

For further analysis on conformity techniques, take into consideration checking out Compliance Resources (nofollow) or discovering Regulative Guidelines (nofollow).

What Is SEPA Verification of Payee (VOP)?

Verification of Payee (VOP) is an anti-fraud initiative being rolled out across SEPA to help ensure that the beneficiary’s name matches the IBAN during a credit transfer. This crucial security layer reduces fraud risk by preventing misdirected or manipulated payments, similar to the UK’s “Confirmation of Payee” system.

Why Is VOP Important for SEPA Payments?

With the rise in invoice fraud, phishing attacks, and APP (Authorized Push Payment) scams, VOP offers a protective validation layer. As SEPA instant and credit transfers gain traction across Europe, ensuring the legitimacy of beneficiaries will soon become an industry standard.

Timeline: Key Dates to Know

- November 2023: European Payments Council issues VOP technical guidelines

- Mid-2024: Banks begin internal integration testing and pilot programs

- Q2–Q3 2025: Full compliance expected for all SEPA credit transfer providers

Source: European Payments Council EPC VOP Documentation

How Compliance-Edge Supports VOP Rollout

Compliance-Edge provides expert regulatory and technical support for financial institutions, EMIs, and fintechs. Here’s how they help organizations stay ahead of VOP requirements:

1. VOP-Ready Compliance Audits

Compliance-Edge performs detailed audits to assess your readiness for VOP, helping you close any process or data gaps before full implementation.

2. Data Matching Infrastructure

We help implement or vet real-time beneficiary name-matching systems integrated with SEPA credit and instant payment flows.

3. Regulatory Documentation & Policy Support

Compliance-Edge assists in drafting mandatory policy updates and aligning your internal documentation with VOP rules.

4. Training & AML Synergy

We offer staff training and AML alignment workshops to ensure your risk team understands how VOP integrates into the broader fraud and compliance framework.

Benefits of VOP for Merchants & PSPs

- ✅ Fraud prevention through name and IBAN validation

- ✅ Customer confidence and reduction in misdirected payments

- ✅ Alignment with EU compliance trends

- ✅ Better audit trails and dispute management

Related Searches

- How to comply with VOP in SEPA

- What is Verification of Payee for fintechs

- SEPA fraud prevention tools

- Compliance-Edge services for banks

- VOP API and integration partners

FAQ: VOP and SEPA Readiness

Q: Who needs to implement VOP?

A: All PSPs operating within SEPA who handle credit transfers will need to adopt VOP standards before 2025.

Q: Is VOP mandatory for SEPA Instant payments?

A: It is highly recommended and may become mandatory for SEPA Instant to further reduce fraud risk in real-time transactions.

Q: How does Compliance-Edge make the transition easier?

A: Compliance-Edge provides technical readiness assessments, helps define operational changes, and ensures your systems meet evolving EPC requirements.

Conclusion

The adoption of Verification of Payee is a critical evolution in the SEPA payments ecosystem. It not only protects consumers but also shields PSPs from costly fraud liabilities. Compliance-Edge offers the expertise and tools to help your organization implement VOP seamlessly and stay compliant with EU regulations. Don’t wait for enforcement—be proactive, be secure.

Affiliate marketing is a powerful driver of sales — but it’s also a prime target for fraud. One of the most common and damaging forms is affiliate fraud, where bad actors exploit affiliate programs to earn illegitimate commissions. In this article, we break down how affiliate fraud works, what it costs your business, and how Compliance Edge helps stop it before it spreads.

What Is Affiliate Fraud?

Affiliate fraud refers to dishonest practices designed to trick affiliate systems into registering fake activity — such as leads, clicks, or sales — that never actually occurred.

Common Types of Affiliate Fraud:

-

Click Fraud: Bots or click farms generate fake clicks to inflate traffic metrics.

-

Cookie Stuffing: Affiliate cookies are injected into a user’s browser without their knowledge.

-

Fake Leads: Fraudsters create false registrations or use stolen data to mimic real signups.

-

Brand Bidding Abuse: Affiliates bid on trademarked terms to hijack traffic and commission.

Why Affiliate Fraud Is a Serious Problem

Affiliate fraud doesn’t just waste your marketing budget. It also:

-

Skews your performance analytics

-

Damages brand trust with legitimate partners

-

Exposes your platform to regulatory and reputational risks

How Compliance Edge Helps

Compliance Edge specializes in fraud prevention and regulatory compliance for affiliate networks, payment providers, and fintech platforms. Their offering includes:

-

Traffic Audits: Behavioral and anomaly-based tracking to detect irregular activity

-

Affiliate Vetting: Full KYC, partner risk scoring, and onboarding controls

-

Live Alerts: Real-time detection of high-risk activity

-

Automated Compliance Reports: Ensure your affiliate program adheres to AML, GDPR, and local laws

What Red Flags Should You Watch?

Q: What are some early warning signs of affiliate fraud?

A: “Unusual traffic spikes, repeated IP addresses, and very high bounce rates are common indicators. We always cross-check engagement against verified user behavior.”

— Compliance Team at Compliance Edge

Related Searches

-

What is affiliate fraud?

-

How to stop fake affiliate leads

-

Best tools to prevent click fraud

-

Compliance monitoring for affiliate programs

FAQ: Affiliate Fraud and Risk Management

Can affiliate fraud be completely prevented?

Not entirely — but with the right tools, its impact can be drastically reduced.

How does Compliance Edge detect fraud?

Using a combination of IP tracking, behavioral analysis, machine learning, and manual review.

Is affiliate fraud a problem for small companies too?

Yes. Fraud often targets new or growing programs that lack full monitoring tools.

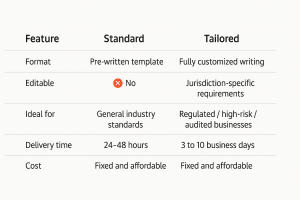

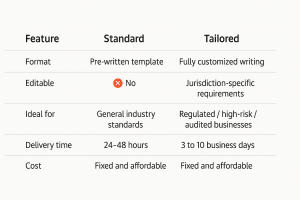

At Compliance-Edge, we offer two distinct formats to support your compliance needs: a ready-to-use Standard offering and a fully customized Tailored offering. Each is designed to meet the specific needs of your industry, risk level, and regulatory obligations.

Standard Offer – Professional Ready-to-Use Templates

Our Standard offer provides pre-written, non-editable policy templates customized only with your company’s name and branding. These documents follow industry best practices and are designed to meet general expectations for most businesses.

Ideal for:

-

Companies not subject to formal audits

-

Platforms seeking a compliance posture without complex obligations

-

Fast and affordable implementation

Benefits:

-

Professional format, immediately usable

-

Aligned with general market standards

-

Suitable for most typical use cases

Tailored Offer – Fully Customized Compliance Policies

Our Tailored offer includes the creation or full redesign of your compliance documentation, adapted specifically to:

-

Your business sector

-

Your actual operational flows

-

Local and international legal obligations

-

Your risk exposure and internal practices

Ideal for:

-

Regulated or high-risk activities

-

Businesses undergoing audits or due diligence

-

Startups and scale-ups building or scaling compliance

Benefits:

-

In-depth analysis of your business model

-

Fully customized and jurisdiction-ready documentation

-

Aligns with partner institutions’ expectations (banks, regulators, PSPs)

Mediated dating is one of the fastest-growing industries but still remains vulnerable to compliance risks such as money laundering, identity fraud, and absence or unverified user verification. The present article recounts the story of a dating platform that lacked regulatory compliance and subsequently got audited by its principal Belgian bank. Following this audit, the platform again approached our team, and within two months, we revamped its entire compliance framework. This case illustrates the role of compliance in any high-risk business and highlights the swift and effective intervention achieved by means of compliance.

The Compliance Gap

When the dating site first came to us, it lacked essential compliance process, exposing the business to numerous risks:

-

Inadequate Know Your Customer (KYC) processes to verify user identities

-

Absence of Anti-Money Laundering (AML) controls to detect suspicious transactions

-

Weak data protection measures, risking GDPR non-compliance

-

Unclear terms of service, leaving gaps in acceptable user behavior and payment processing protocols

These gaps had triggered red flags for the bank, which required the platform to undergo a comprehensive audit to assess its regulatory posture.

The Bank’s Audit Process

Belgian banks operate under stringent regulations from the Financial Services and Markets Authority (FSMA) and are responsible for conducting due diligence on high-risk clients. The audit revealed:

-

Gaps in transaction monitoring for suspicious patterns

-

Insufficient user onboarding procedures, particularly in KYC and age verification

-

Weak internal policies regarding GDPR adherence and user data protection

-

Mismatches between revenue streams and disclosed business activities

These findings put the bank at risk of regulatory penalties and threatened the dating site’s ability to maintain its banking relationship.

Our Approach: Rapid Compliance Overhaul in Two Months

Recognizing the urgency of the situation, our team implemented a tailored, comprehensive compliance plan that addressed all audit concerns within a two-month timeline:

-

KYC Implementation: We deployed robust identity verification processes, ensuring only verified users could access the platform.

-

AML Program Development: We designed and integrated a customized AML compliance program, including automated transaction monitoring and suspicious activity reporting.

-

GDPR Compliance: Our team developed clear privacy policies and secure data storage solutions, ensuring full GDPR compliance.

-

Transparent Payment Processing: We established traceable and compliant payment processing channels, reducing the risk of financial misconduct.

-

Internal Audits and Staff Training: Regular internal audits and comprehensive staff training programs were introduced to maintain long-term compliance.

Results and Impact

Our intervention allowed the dating site to:

-

Pass a follow-up audit conducted by the Belgian bank, securing its banking partnership

-

Restore trust among users through enhanced data protection and transparent operations

-

Ensure long-term sustainability with a fully compliant operational model

The case illustrates how fast and effective compliance turnaround can transform high-risk businesses. In two months, we enabled our client-a dating site subjected to regulatory scrutiny-to become fully compliant and re-established trust with its banking partner. Since the online dating business is very sensitive, for many businesses, compliance is not just a legal requirement, it is a key strategic asset that ensures growth, trust, and operational stability.

Introduction

The European online casino market is growing rapidly, driven by digital advancements and increasing demand for accessible gaming experiences. In response to this growth, European regulators are implementing measures aimed at strengthening consumer protection, ensuring operational transparency, and maintaining compliance with legal standards. This trend highlights a shared commitment to regulating a high-risk sector that is often exposed to illegal practices and risks for vulnerable players.

Regulatory Context in Europe

Europe presents a fragmented regulatory landscape, with each member state implementing its own rules. However, some general trends are emerging:

Mandatory licenses: Most European countries require specific licenses for legal operations. For example, Belgium mandates an A+ license for online casinos, while the United Kingdom relies on the UK Gambling Commission to regulate the market.

Player protection: Measures such as deposit limits, self-exclusion tools, and age verification have become standard practices to safeguard consumers from gambling addiction risks.

Transparency standards: Operators must provide clear information on winning odds, general terms and conditions, and the risks associated with gambling.

New Challenges and Regulatory Responses

As technology evolves, new challenges arise:

Illegal gambling and black markets: A significant portion of the European online casino market remains unregulated, exposing players to increased risks.

Responsible advertising: Some countries, such as Italy, have banned gambling advertisements to protect vulnerable groups.

Emerging technologies: The use of cryptocurrencies and blockchain technology introduces new regulatory challenges.

To address these challenges, several member states are reinforcing their regulatory frameworks. For instance, France is considering the gradual opening of its online casino market under strict rules designed to ensure player safety and generate tax revenue.

Towards European Harmonization

The European Commission could play a crucial role in developing a more harmonized approach by:

Establishing minimum standards for player protection across Europe.

Encouraging information sharing among national authorities to combat illegal platforms effectively.

Defining common rules for the use of new technologies in the industry.

Harmonization would simplify procedures for operators seeking to provide services across multiple European countries while ensuring a high level of consumer protection.

The Importance of Compliance for Operators

To operate legally, online casino platforms must:

Comply with local regulations, including licensing requirements, KYC controls, and responsible gaming policies.

Adopt ethical practices to protect vulnerable players.

Strengthen cybersecurity measures to safeguard personal and financial data.

Non-compliant operators face severe penalties, including license suspension and heavy fines.

Conclusion

The evolution of online casino regulation in Europe demonstrates a growing commitment to consumer protection, transparency, and combating the black market. Although each country sets its own regulations, harmonization at the European level could offer a more coherent and secure framework that benefits both players and legitimate operators.

As the sector continues to expand, compliance will remain a key challenge. Companies operating in this market must continue adapting to meet regulatory expectations and provide a safe, responsible gaming environment.

In today’s world, tools like ChatGPT make it tempting to take a DIY approach to crafting compliance documents. Type a few prompts, hit generate, and voilà—a seemingly professional document in minutes. But is it really that simple? When it comes to regulatory compliance, cutting corners can be a costly mistake. Here’s why partnering with Compliance-Edge is the smarter choice for your high-risk business.

1. Tailored Expertise vs. Generalized Outputs

ChatGPT is an incredible tool for generating ideas or drafting general content, but it lacks the specialized expertise that high-risk industries demand. Compliance-Edge brings:

- Industry-Specific Knowledge: We understand the nuances of sectors like gaming, adult business….

- Regulatory Context: Our documents align with specific laws and banking requirements in your jurisdiction.

- Customization: We tailor every word to your unique business needs and risks.

With ChatGPT, you get a generic template. With us, you get a document that passes scrutiny from banks and regulators.

2. Compliance Is More Than Words

A compliance document isn’t just a collection of legal jargon—it’s a strategic tool that demonstrates your commitment to following the rules. Regulators and banks look for:

- Operational Details: How your policies translate into daily practices.

- Practical Applications: Step-by-step processes for AML/KYC, risk management, and reporting.

- Credibility: The confidence that your document reflects real-world implementation.

ChatGPT can’t guarantee any of this because it doesn’t know your operations. Compliance-Edge works closely with you to create documents that are both practical and credible.

3. Avoiding Costly Mistakes

Imagine relying on an AI tool to produce a document that misses key compliance elements. The consequences?

- Banking Relationship Risks: A poorly written policy could cost you your banking partner.

- Reputation Damage: Failing an audit could harm your credibility with clients and partners.

Compliance-Edge ensures nothing falls through the cracks, helping you avoid mistakes that AI tools simply can’t predict or account for.

4. Staying Ahead of Regulatory Changes

Regulations are constantly evolving. ChatGPT generates content based on its training data, which may not reflect current laws or emerging standards. Compliance-Edge stays up-to-date on:

- Local and International Regulations: From GDPR to FATF guidelines.

- Industry Trends: New challenges in AML/CFT for high-risk businesses.

We ensure your documents are not just compliant today but future-proof against tomorrow’s changes.

5. Banks and Regulators Trust Experts

Banks and regulators welcome documentation produced by compliance professionals who understand their business inside and out. An AI-generated document can trigger red flags, whereas a document produced by Compliance-Edge demonstrates:

- You’ve invested in professional expertise.

- Your policies are based on real-life best practice.

- You take compliance matters seriously.

Trust isn’t built with shortcuts, it’s earned with quality, care and expertise.

The Compliance-Edge Advantage

When you choose Compliance-Edge, you’re not just outsourcing a task—you’re investing in peace of mind, knowing that your business is protected by documents crafted to the highest standards. AI tools like ChatGPT have their place, but for something as critical as compliance, there’s no substitute for human expertise backed by industry insight.

So why settle for “good enough” when you can have the ultimate? Let Compliance-Edge take care of your compliance needs, so you can focus on growing your business..

#ComplianceEdge #RiskManagement #AMLCompliance #TrustAndTransparency #WhyExpertsMatter #BusinessIntegrity #HighRiskBusiness #AIvsExperts #WinningWithCompliance #CorporateGovernance

Regulatory compliance is a cornerstone of modern business operations, yet it is plagued by complexities, ambiguities, and contradictions within legal and procedural documents. These challenges often lead to inefficiencies, compliance failures, and increased costs. The advent of Large Language Models (LLMs) such as GPT-4.0 offers a promising avenue to address these issues. Recent experiments have demonstrated GPT-4.0’s capacity to detect inconsistencies in regulatory texts. Using a specialized dataset enriched with ambiguities and contradictions, designed collaboratively with compliance architects, the model achieved high levels of precision, recall, and F1 scores. This performance was validated against human expert evaluations, confirming that LLMs can play a significant role in parsing and analyzing regulatory documents.

Despite this success, these findings merely scratch the surface of what LLMs can offer. The next steps in this research focus not just on identifying inconsistencies but also on resolving them and applying these insights in real-world compliance processes. Future work will enhance detection models by expanding training datasets with real-world regulatory inconsistencies, leveraging transfer learning to adapt LLMs to industry-specific needs, and developing advanced scoring mechanisms to prioritize high-impact inconsistencies. The ultimate goal is not only to detect inconsistencies but to offer solutions, such as proposing harmonized resolutions based on contextual understanding and precedence, ranking recommendations by legal validity and practical feasibility, and providing traceable explanations for suggested resolutions to facilitate human oversight.

Integration with compliance workflows will be essential to maximize utility, including building APIs and plugins to incorporate LLMs into compliance systems, developing user-friendly dashboards for efficient review, and enabling real-time document analysis during negotiations or regulatory updates. Collaboration with industry partners in high-risk sectors like finance, gaming, and healthcare will play a key role, involving pilot projects to test real-world applicability, gathering feedback to refine models, and aligning solutions with legal requirements. Future models must also scale to handle multilingual regulations, large volumes of documents, and dynamic updates reflecting new laws.

The regulatory landscape is vast and ever-changing, and LLMs like GPT-4.0 could enable organizations to stay proactive by reducing operational costs, enhancing accuracy, and supporting proactive compliance. Advanced pretraining on cross-jurisdictional datasets and real-time learning algorithms will ensure models remain up-to-date, capable of delivering instant insights. The potential extends beyond conflict detection and resolution to redefining compliance practices, transforming compliance from a reactive obligation into a proactive strategy that minimizes legal risks and improves efficiency.

The next decade will likely see these models evolve from sophisticated assistants to indispensable tools in regulatory management, exploring multilingual document harmonization, real-time policy updates, and scalable deployment frameworks. By addressing the challenges of ambiguity, complexity, and inconsistency, LLMs hold the potential to redefine how businesses approach compliance. The future of compliance is here, and it speaks the language of AI.

In today’s interconnected world, the relationship between cybersecurity and compliance is not just significant but inseparable. Organizations face mounting regulatory pressures to protect data and systems, while cyber threats grow in scale and sophistication. Compliance establishes the legal and ethical framework that companies must follow, and cybersecurity provides the tools and strategies to meet those requirements. Together, they form the backbone of risk management in the digital age.

Why Cybersecurity and Compliance Go Hand in Hand

Compliance Defines the “What,” Cybersecurity Delivers the “How”: Regulatory frameworks like GDPR, HIPAA, and PCI DSS specify what organizations must do to safeguard data. Cybersecurity, in turn, implements the necessary measures—such as encryption, firewalls, and multi-factor authentication (MFA)—to meet these obligations.

Protecting Sensitive Data: Data breaches not only expose organizations to cyber threats but also lead to non-compliance, attracting hefty fines and legal scrutiny. For example, GDPR mandates data protection by design, which requires robust cybersecurity practices.

Mitigating Risk of Regulatory Sanctions: Non-compliance due to inadequate cybersecurity can result in penalties, reputational damage, and loss of trust. Organizations must integrate both disciplines to avoid these risks.

Real-World Examples from 2024: Lessons Learned

1. SEC Crackdown Post-SolarWinds Breach In October 2024, the U.S. Securities and Exchange Commission (SEC) settled enforcement actions against multiple companies, including Mimecast and Avaya Holdings. These companies were penalized for misleading disclosures related to the 2020 SolarWinds cyberattack. The SEC’s actions highlight the importance of accurate incident reporting as part of compliance and the need for robust cybersecurity measures to detect and manage breaches effectively.

Key Takeaway: Organizations must establish incident response plans that align with compliance requirements to avoid regulatory scrutiny.

2. UnitedHealth Group’s Cybersecurity Failures UnitedHealth Group faced calls for investigation by the FTC and SEC following a cyberattack on its Change Healthcare unit. The attack exposed patient data due to inadequate cybersecurity measures like missing MFA. This not only violated privacy laws but also posed significant compliance risks.

Key Takeaway: Basic cybersecurity practices, such as MFA, are critical for compliance with healthcare regulations like HIPAA.

3. EPA Urges Water Utilities to Strengthen Cybersecurity In 2024, the Environmental Protection Agency (EPA) reported that 70% of U.S. water utilities failed to meet cybersecurity standards, making them vulnerable to attacks. The EPA’s warnings emphasized the need for compliance with federal security requirements to protect critical infrastructure.

Key Takeaway: Compliance-driven cybersecurity audits are essential for critical sectors to mitigate risks and maintain regulatory trust.

4. GDPR Violation in European Parliament’s Data Breach A breach in the European Parliament’s recruiting platform exposed sensitive data of over 8,000 staff members. This incident led to legal complaints for violating GDPR, showcasing how cybersecurity failures can directly lead to non-compliance.

Key Takeaway: Data protection laws like GDPR demand proactive cybersecurity measures to secure sensitive information.

How Organizations Can Align Cybersecurity and Compliance

Conduct Regular Risk Assessments: Identify vulnerabilities and evaluate how they affect compliance requirements. For example, ensure data encryption for GDPR compliance.

Implement Incident Response Plans: Develop protocols for reporting and mitigating breaches to meet regulatory timelines (e.g., 72-hour notification under GDPR).

Adopt Cybersecurity Frameworks: Use industry standards like NIST or ISO 27001 to bridge the gap between cybersecurity and compliance.

Invest in Employee Training: Train staff on phishing awareness, secure practices, and compliance policies to reduce insider threats.

Partner with Cybersecurity Experts: Leverage third-party expertise to audit systems, monitor threats, and stay updated on evolving compliance standards.

The Future of Cybersecurity and Compliance

As cyber threats grow, the overlap between cybersecurity and compliance will deepen. Organizations must view these disciplines as interconnected rather than separate functions. By investing in technology, training, and proactive risk management, companies can not only secure their systems but also build a culture of compliance that fosters trust and resilience.

In 2024, the lesson is clear: cybersecurity is no longer optional for compliance—it is its foundation.

The Corporate Transparency Act (CTA), enacted in January 2021, has reshaped Beneficial Ownership Declaration requirements in the United States, with full implementation scheduled by 2024. The law mandates that certain U.S.-based business entities report their beneficial owners to the Financial Crimes Enforcement Network (FinCEN)

What Has Changed?

Mandatory Reporting:

- Limited Liability Companies (LLCs), corporations, and similar entities must disclose their beneficial owners to FinCEN.

Definition of Beneficial Owner:

- Any person holding at least 25% ownership or exercising substantial control over the company.

Required Information:

- Full legal name

- Date of birth

- Current residential address

- Identification number (e.g., passport, driver’s license)

Notable Exemptions:

- Publicly traded companies (Publicly traded companies are exempt from the Beneficial Ownership Declaration requirement of the Corporate Transparency Act (CTA) because they are already subject to extensive regulatory oversight and transparency rules enforced by U.S. government agencies.)

- Banks and credit unions (Banks are exempt from the Beneficial Ownership Declaration requirement under the Corporate Transparency Act (CTA) because they are already subject to stringent regulatory oversight through other U.S. financial laws.)

- Non-profit organizations (Non-profit organizations are exempt from the Beneficial Ownership Declaration requirement of the Corporate Transparency Act (CTA) due to their unique legal and operational structures, which prioritize transparency and public accountability)

Penalties for Non-Compliance:

- Fines up to $10,000

- Imprisonment up to 2 years for willful failure to report or providing false information.

When to File?

- New Entities (created after January 1, 2024): Must file within 30 days of incorporation.

- Existing Entities (formed before 2024): Must file before January 2025